Make Decentralized Governance Great (Again?)

An Overview of the Current Challenges Facing Decentralized Governance in DeFi and Ideas for the Future

*Part 1 of a 2-part essay series on the current state of decentralized governance in crypto. This essay is followed by “Governance as a Source of Value.”

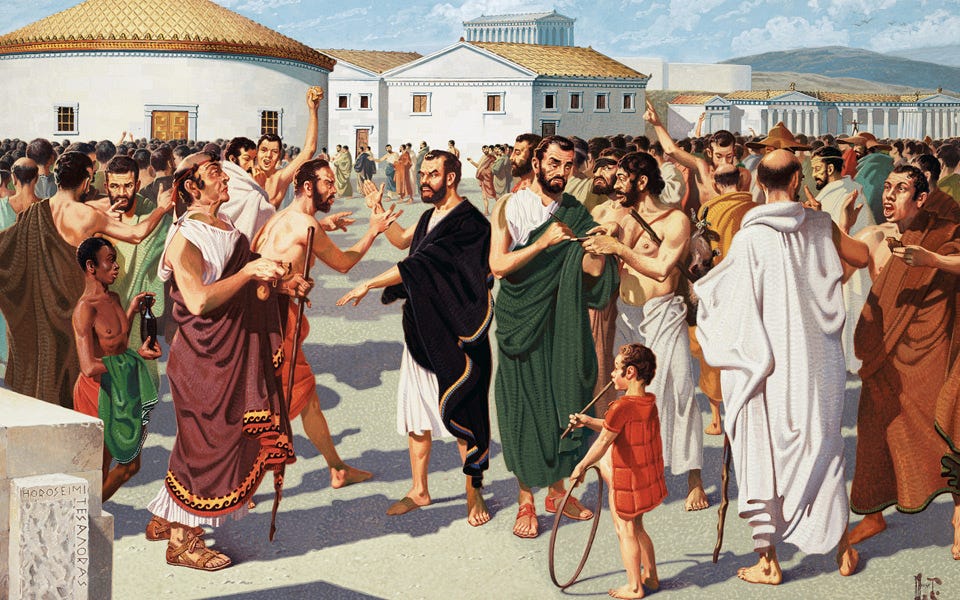

Decentralized governance is at the heart of the ideological foundation of crypto: equal opportunity for all actors to participate. Particularly in decentralized finance (DeFi), more and more projects are following the playbook of progressive decentralization and turning the keys to their protocol over to their communities. This means that users and tokenholders, in addition to team members and institutional investors, have more control over protocol parameters, treasury spending, and more generally, the industry’s future.

To enable this revolution in governance systems, DeFi protocols utilize decentralized autonomous organizations (DAOs). Without going into too much detail (as the subject has been written about many times), DAOs are a way to aggregate financial and human capital according to rules encoded on a blockchain. The vital differentiator between DAOs and traditional businesses or corporations is that they coordinate rather than control their participants. Ideally, anyone should be allowed to contribute funds or ideas, and a DAO should be able to translate that input into real outcomes. DeFi protocol DAOs continually experiment with various decentralized governance implementations, including organizing contributors through committees (see: Synthetix) and distributing capital through grants programs (see: Aave, Compound, and Uniswap).

While the goals of DAOs and decentralized governance remain honorable, many challenges stand in the way of achieving them. In this essay, I cover three of the most pressing, along with accompanying recommendations to address them. These challenges are: separating signal from noise, establishing consistent leadership, and ensuring an impactful community.

SIGNAL VS NOISE

Most DeFi applications today use some combination of online forums (examples here and here) and Discord channels to coordinate the social layer of governance. Apps like Snapshot are then used to execute “off-chain” voting to determine community consensus before protocol changes are encoded on the blockchain. While this organic evolution of DeFi governance ensures open participation and captures wide-ranging perspectives, the process becomes noisy, with proposal, discussion, and voting splintered across many platforms. As certain project communities have grown in size, the amount of individual contributions taking place in separate locations has begun to obfuscate the discussion. This added complexity is a hinderance to governance proceedings, as it takes time to parse through the sheer volume of posts, determining which add unique value while the most value-added ideas get lost among the crowd. In addition, this clunky experience serves as another barrier to entry for newcomers who feel overwhelmed by the amount of material required to get up to speed and the amount of places they need to go to get it.

Moving forward, it is necessary to streamline the proposal and discussion process in order to separate the signal from the noise and balance inclusion with efficacy. For example, Boardroom, a governance app, offers a new ideation tool that allows the community to show support for new ideas through a mechanism similar to Reddit’s upvoting feature. This way, users can easily sort through the best and most value-added discussions as voted on by the community. In addition, Cinneamhain Ventures partner Adam Cochran recently suggested that decentralized protocols should learn from traditional political bill sponsoring. Currently, when a DeFi community member proposes an idea in governance forums, a multitude of responses spring up, many of which may be quite similar. Instead of each participant pulling the discussion in their own direction, which may not be much different from other opinions, Cochran stresses the importance of making small concessions in order to acquire support from fellow policy makers and come to some sort of consensus prior to subsequent discussion. It is important to note, however, that this should not come at the cost of centralizing influence or sacrificing transparency.

In order to increase governance efficiency, while maintaining wide participation and distributed control, I believe that most of the discussion and consensus process needs to happen at the DAO level. It is important to note that while most DeFi applications are governed by DAOs (or plan to at some point in the future), not all DAOs are DeFi protocol DAOs.

I envision a future where DAOs become a more fundamental entity of DeFi protocol ownership and consequently, more active in protocol governance. Individuals will still be able to hold and vote with their own tokens, but DAOs representing a larger body of individuals will ultimately obtain greater power and status within protocol communities. DAOs have the ability to pool the tokens and aggregate the views of their members, and thus, are able to speak for a wide range of individuals after consensus has been achieved within their own community. DAOs assuming a bigger role in protocol governance on behalf of their constituencies will add more order to the idea generation and feedback processes, while still recognizing the diverse opinions of all their stakeholders.

PROTOCOL LEADERSHIP

Synthetix’s former “benevolent dictator” Kain Warwick recently detailed an issue that arose from the protocol’s decentralized governance structure. Warwick recounts stepping away from his de facto leadership position and leaving the Spartan Council, a body democratically elected by the community, responsible for approving proposed changes to the Synthetix protocol, and unofficially in charge of the project’s core contributors. Warwick notes, “The Council was never intended to be directly in control of the core contributors, but rather to create a legitimate mechanism for token holders to control the direction of the protocol.” Thus, without Warwick’s focused management and direction, there was functionally no one in charge of the core contributors, which led to significant coordination and implementation issues. This illustrates an interesting distinction between operational governance and strategic governance and poses the question of who should oversee what aspect of a project.

The bottom line: a mature decentralized project doesn’t need a leader, but its core contributors do. While aggregating the diverse inputs of a community can positively impact the growth and trajectory of a protocol, this process can also bog down and often overlook day-to-day protocol maintenance and implementation. Part of this is due to participant apathy regarding the minutia of running a DeFi application, while part of this is due to the general chaotic nature of decentralized governance. As such, when progressively decentralizing your protocol governance, it is important to clearly delineate the operations of the core contributor team and have a dedicated and motivated leader to coordinate them.

In reality, decentralized governance is not good for every aspect of a project. First, more consolidated control is necessary during the early stages of protocol development and community formation. Once the project reaches a certain level of maturity, the community can then retain the power to propose and vote on key protocol changes and influence the overall strategic direction of the project. The Synthetix case study demonstrates that steady leadership is also needed to organize ongoing operations. And while I recognize that the term “leadership” generally bears the connotation of centralized power, the transparency of blockchain technology ensures ultimate accountability for any on-chain changes or transactions made without community agreement.

THE PERCEPTION OF CONTROL

In order for the decentralized governance model to work, the community of users and tokenholders either need to have control over the protocol, or at least feel like they do. This means that even if the community doesn’t own more tokens than insiders (team members and investors), their collective voice should be heard and considered in all major strategic initiatives. Not only is this the very point of decentralized governance, but the perception that community contributions are valued adds meaning to community membership and participation. One of the primary shortcomings of today’s local government is voter apathy, claiming your vote “doesn’t mean much,” which leads to low election turnout and results that are unrepresentative of the electoral base (and a similar argument can be made for shareholder voting). If people believe their input and participation has an impact, they are more likely to engage and put more energy towards providing value-added contributions. Thus, DeFi protocols can improve decentralized governance by increasing a community’s emotional stake in the process, while also wielding the power of the financial incentives inherently baked into token ownership.

We have recently watched this hypothesis play out in real time with the simultaneous events of Uniswap's DeFi Education Fund and Sushiswap's strategic fund raise. In the first case, a group of influential Uniswap users passed a proposal to form the “DeFi Education Fund” (DEF), a fund to address government action aimed at cryptocurrencies. The problem began when the Consensus Check, the last stage in Uniswap’s governance process before on-chain voting and implementation, showed that over 96 percent of the votes in favor of the proposal came from only 10 wallets (the largest of which was controlled by the writer of the proposal, the Harvard Law Blockchain and Fintech Initiative). In addition, after successfully funding the DEF with 1 million UNI tokens, the DEF immediately sold half of its UNI holdings for USDC after claiming it planned to allocate the funds over 4-5 years. This raised questions about the legitimacy of the fund and whether formation of the DEF was in the best interest of UNI tokenholders. Uniswap’s decentralized governance already had a reputation for being more form than substance (which previously caused voter apathy issues) and this public incident further diminished the community’s belief in their ability to materially impact the project.

On the other hand, Sushiswap core contributor, 0xMaki, recently posted plans to diversify the protocol’s treasury on the community forum. The team would sell an agreed-upon amount of SUSHI for dollars to an agreed-upon list of VCs, with a portion allocated for community members as well. At first, the community expressed many concerns with the proposal, primarily regarding the token price the team was planning to offer the VCs, which included a discount to the current market price. While this discount may be characteristic of similar strategic funding rounds, and compensation for the initial illiquidity of the tokens due to the proposed vesting schedules, the community believed that the raise, as proposed, unequally benefitted a small group of insiders. The ensuing discussion saw many prominent crypto VCs both amending the proposal to accommodate these concerns, as well as further appealing to the community regarding the value they could bring to the project. Instead of a group of insiders opaquely transacting in their own interest, a wider assembly of stakeholders had their voices heard and made sure that the raise would be in the entire community’s interest. While this is yet to fully play out, I am sure that the final proposal will benefit from such a wide range of input and Sushiswap the protocol will benefit from instilling confidence in their decentralized governance process.

CONCLUSION

Within DeFi, decentralized governance allows all stakeholders to have a voice in protocol development and value creation. By welcoming more diverse ideas and beliefs, DeFi projects, and most crypto projects in general, have the potential to create more value for their communities and generate more social good than their centralized counterparts. However, to produce these benefits, a project should not have to sacrifice operational efficiency. Just as traditional firms were created to minimize transaction costs, decentralized governance implemented through DAOs can completely transform the slog of institutional bureaucratic decision making. In order to run more efficiently, while promoting ever-greater inclusivity, DeFi projects should encourage increased DAO participation in protocol governance, delineate roles and responsibilities between strategy and operations, and maximize the perceived value of community contributions.

Experimentation remains one of the “killer applications” of DeFi and crypto. In addition to testing incentive mechanisms and financial primitives, founders and developers are able to endlessly test various governance processes. Leveraging the automation and transparency enabled by cryptocurrency and blockchain technology, systems designers and policy makers are able to explore different ways to boost participation, enhance efficiency, and increase fairness. The results of these experiments will inevitably help these projects to continue to innovate, propelling the entire industry forward.